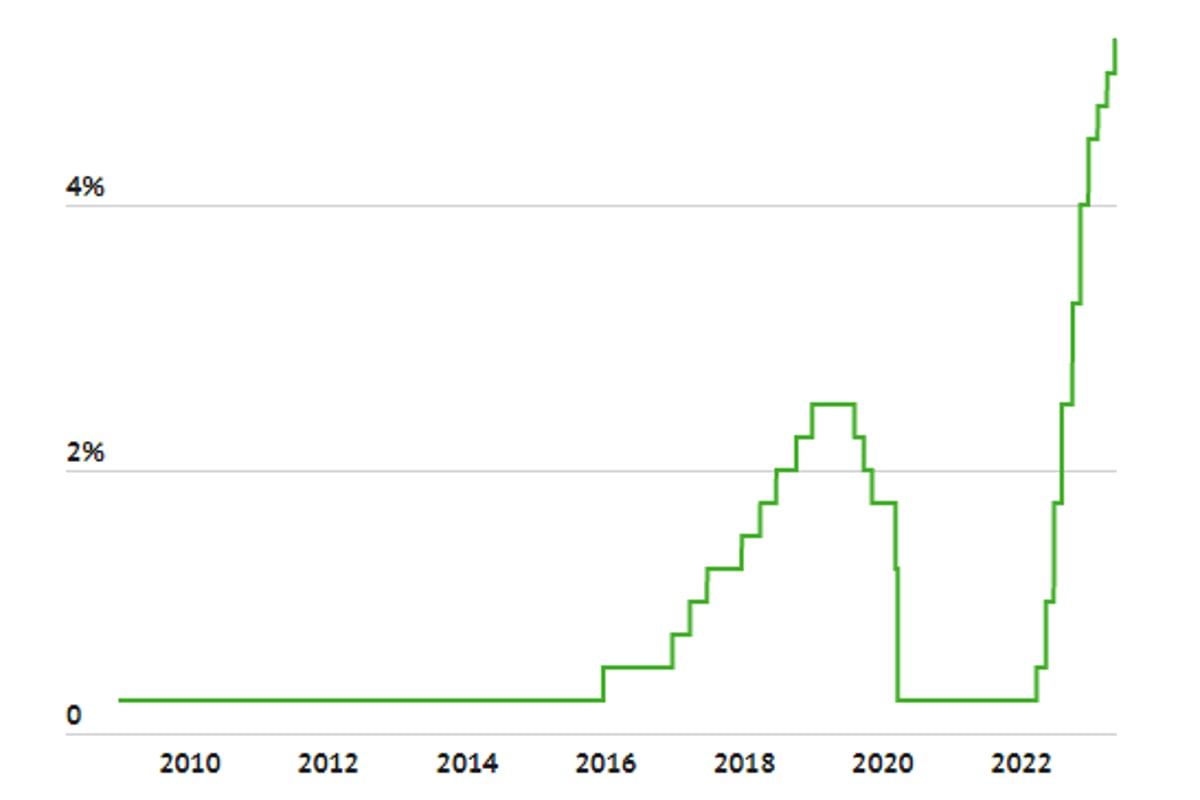

The average rate on credit cards with assessed interest was 2275 percent at the end of 2023 according to the Federal Reserve compared with 2040 percent in 2022 and 1617 percent at the end of. The Federal Reserve is expected to hold interest rates steady for the fifth time at the conclusion of its two-day policy meeting on Wednesday. Powell will surely be pressed on the topic at a news conference Wednesday after the Fed ends its latest two-day policy meeting The Feds interest-rate-setting committee is how or. The latest projections show the median policymaker expectation is for the Feds benchmark overnight interest rate to fall three-quarters of a percentage point in 2025 less than the 1 percentage. The Federal Open Market Committees FOMC latest decision means the Feds key benchmark interest rate will not move from its current target range of 525-55 percent a 23-year high..

Federal Reserve Fed will meet to set interest rates eight times in 2023. Web The FOMC holds eight regularly scheduled meetings during the year and other meetings as needed. Web The average rate on credit cards with assessed interest was 2275 percent at the end of 2023 according. Web Federal Reserve Meeting Fed Raises Rates Again Policymakers increased interest rates by a quarter. Web Washington DC CNN The Federal Reserve said Wednesday it will hold interest rates steady at a 22-year..

Result Fed holds rates steady indicates three cuts coming in 2024. . . The Federal Reserve decided to leave interest rates alone at its final meeting. Federal Reserve is almost certain to hold interest rates steady at the. Result Fed Meeting December 2023 Live Analysis on Interest Rates Powell Speech -. Result Board of Governors of the Federal Reserve System. 13 2023 at 613 PM EST..

The average rate on credit cards with assessed interest was 2275 percent at the end of 2023 according to the Federal Reserve compared with 2040 percent in 2022 and 1617 percent at. Traders await insight from central bank on the outlook for rate cuts Investors almost unanimously expect that policymakers will stand pat on interest. March 20 2024 at 545 AM EDT The Federal Reserve is firmly in the spotlight today The central bank is widely expected to keep interest rates unchanged. Officials agreed to a 075-percentage-point rate rise at their two-day policy meeting that concluded Wednesday which will increase the Feds benchmark federal-funds rate to a. The Fed is unlikely to change interest rates when it releases its decision at 2 pm ET todaythe data doesnt support a cut But any change in policymakers interest-rate forecasts..

Comments